home

Briefing Paper 9 and Policy Brief 64 - Integrating China into Multilateral Debt Relief: Progress and Problems in the G20 DSSI

April 3, 2023

Deborah Brautigam and Yufan Huang provide the first in-depth evaluation of China’s participation in a major multilateral experiment in sovereign debt management: the G20’s COVID-19 Debt Service Suspension Initiative (DSSI). Through analysis of available data, more than 100 interviews, and fieldwork in Angola, Kenya, and Zambia, we argue, with some caveats, that the DSSI was a success. First, it succeeded in providing a pathway for China, the world’s largest bilateral creditor, to negotiate debt treatments together with the Paris Club in the Common Framework. Second, China fulfilled its role fairly well as a responsible G20 stakeholder. In the 46 countries that participated in the DSSI, Chinese creditors accounted for 30 percent of all claims, and contributed 63 percent of debt service suspensions. Finally, the DSSI pushed the Chinese government to align interests among fragmented banks and bureaucracies with conflicting goals. This process, still underway, is a necessary step toward full acceptance of the necessity for debt restructuring in the post-pandemic era.

Working Paper 53 and Policy Brief 63 - From Contractors to Investors? Evolving Engagement of Chinese State Capital in Global Infrastructure Development and the Case of Lekki Port in Nigeria

February 14, 2023

Will China continue to finance global infrastructure development in the same way it used to? As the world, and especially China itself, re-emerges from the COVID-19 pandemic, the answer to this question will shape the global political economy of development in the years to come. In January 2023, Nigeria inaugurated Lekki Port, the country’s first deep seaport as well as the first port project executed through “integrated investment, construction, and operation” (IICO) by a Chinese company in Africa. Using the Lekki Port case, Hong Zhang argues that the Chinese financing model is likely to change as required by the evolving needs of China’s infrastructure industry, specifically their desire to move up the value chain. However, Chinese state-owned enterprises (SOEs) and financial institutions face a steep learning curve in their attempt to upgrade. Collaboration with international actors from advanced economies is one way forward.

Briefing Paper 8 - Evolution of Chinese Lending to Sri Lanka Since the mid-2000s: Separating Myth from Reality

November 29, 2022

Sri Lanka’s April 2022 default has brought renewed attention to Chinese lending on the troubled island. Umesh Moramudali and Thilina Panduwawala’s new briefing paper, based on their Freedom of Information requests, shows that loans from Chinese banks now constitute 19.6 percent of public debt, much higher than the often quoted 10 to 15 percent. All this debt was duly reported to the World Bank’s International Debt Statistics. Interest rates on Chinese loans averaged 3.2 percent – higher than Japanese, World Bank, and ADB loans, but significantly lower than Eurobonds (6.9 percent). While much commentary has charged China with “asset seizure” in the case of the lease of Hambantota Port, debt service for the Port came to only 2.4 percent of Sri Lanka’s total payments in 2017, the year the port was leased. There was no default on the port loans in 2017. Loan contracts obtained by the authors show no evidence of the port serving as collateral for the Chinese loans (see the special appendix here).

Working Paper 52 and Policy Brief 62 - How Africa Borrows From China: And Why Mombasa Port is Not Collateral for Kenya's Standard Gauge

April 14, 2022

In December 2018, a leaked letter from Kenya's Auditor General warned that the Kenya Ports Authority's assets - of which Mombasa Port is the most valuable - risked being taken over by China Eximbank if Kenya defaulted on the Standard Gauge Railway loans. The rumor that Kenya had used Mombasa Port as collateral for the railway became widely accepted globally as another example of "Chinese debt-trap diplomacy." In Working Paper 52 and Policy Brief 62, Deborah Brautigam, Vijay Bhalaki, Laure Deron, and Yinxuan Wang unpack this case using tools of international contract law and commercial project finance. Their detailed forensic analysis shows why the rumor is wrong. Rather than a deliberate debt trap, the railway project was carefully and creatively designed to reduce the risks of sovereign default and enhance the bankability of an infrastructure project with high costs but significant long-term benefits for Kenya and the region.

Briefing Paper 7 – Montenegro, China, and the Media: A Highway to Disinformation?

December 8, 2021

On June 21, 2021, the French public television channel France 2 aired a report in which it was stated that Montenegro, a heavily indebted nation, was at risk of “having to cede some of its land to China” as a result of its inability to pay back a loan for the construction of a highway. According to reporters, Montenegro’s Port of Bar could be annexed by China “completely legally,” thanks to an “extraordinary contract” that had been “never seen before in Europe (...).” In reality, reporters erroneously presented a standard sovereign immunity waiver as evidence that China is entitled to seize land in Montenegro in the case of a payment default, reflecting their lack of understanding of normal international legal practice. Laure Deron, Thierry Pairault, and Paola Pasquali argue that criticism of problematic Chinese lending practices must be based on facts, not unfair and misguided denunciation.

Briefing Paper 6 – What is the Real Story of China’s “Hidden Debt”?

October 26, 2021

On September 29, AidData, a research lab at William & Mary, released a detailed overview of their new data on China’s global lending, Banking on the Belt and Road. The report has generated much commentary. Yet most people will likely read only the headlines: that US$ 385 billion of a purported US$ 676 billion in Chinese loans made to developing countries between 2000 and 2017 was not being reported to the World Bank. CARI has released this week a new briefing paper examining the data underpinning the AidData conclusions.

In Briefing Paper 6, "What is the Real Story of China’s “Hidden Debt”?, Deborah Brautigam and Yufan Huang conduct their own analysis of the data and diverge significantly from AidData's headline conclusions. While they agree with many of the researchers' points, Brautigam and Huang argue that by providing averages, glossing over outliers, and allocating the entire Chinese loan for joint ventures to only the host government partner, the AidData report is unduly alarmist. They also draw lessons from the new dataset for international institutions and national governments seeking to improve debt transparency.

Working Paper 51, Briefing Paper 5, and Policy Brief 61 – Zambia’s Chinese Debt in the Pandemic Era

September 28, 2021

Zambia's debt difficulties hit headlines in November 2020 when the country defaulted on its Eurobond payments. In August 2021 a new president, Hakainde Hichilema, took office, facing a debt burden that had never been fully transparent to Zambia’s public and the world. CARI has released three new papers aiming to shed light on Zambia's Chinese debt dilemmas.

In Briefing Paper 5, "Zambia's Chinese Debt in the Pandemic Era," Deborah Brautigam and Yinxuan Wang use CARI data and research on loan disbursements and repayments to estimate Zambia’s outstanding external public debt to all Chinese financiers, official and commercial, at approximately US$6.6 billion, more than double that of the most commonly cited figure for Chinese debt in Zambia (US$3 billion).

In Working Paper 51, "How China and Zambia Co-Created a Debt 'Tragedy of the Commons'," Deborah Brautigam analyzes how Chinese creditors, contractors, and Zambian stakeholders failed to take steps to make Zambia's borrowing sustainable. Curious why Zambia was a clear outlier, the author explores the system for project development and loan approval in Zambia and China.

In Policy Brief 61, "How China and Zambia Co-Created a Debt 'Tragedy of the Commons'," Deborah Brautigam develops the insights from Working Paper 51 in a short-form piece aimed at policymakers. The author offers concrete policy points and recommendations for leaders in Zambia, China, and the G20/Paris Club.

Policy Brief 60 and Working Paper 50 – China’s Digital Silk Road in Africa and the Future of Internet Governance

August 5, 2021

The Digital Silk Road (DSR) is a Chinese policy initiative launched in 2015, yet six years later there is relatively little concrete information about what it has achieved so far. Henry Tugendhat and Julia Voo offer a preliminary analysis of what the DSR entails in Africa. Discover their findings, including how Chinese lending for technology projects in Africa was actually greater before the launch of the DSR than after.

Policy Brief 59 – Chinese Resource-Backed Infrastructure Financing Investments: Comparing Governance in Guinea and Ghana

July 27, 2021

This policy brief is an output of the CARI-funded SAIS-IDEV student practicum for the 2020-2021 academic year, based on the two cases provided by the Transnational Environmental Accountability Project (TEA Project).

Read on as authors Qianrong Ding, Hayden Hubbard, Emily Larkin, and Dawalola Shonibare conclude that although resource-backed infrastructure agreements provide needed investment into Ghana and Guinea, the lack of transparency in these agreements has created serious environmental, social, and governance concerns.

These concerns are in part due to a history of poor regulatory compliance by Chinese firms in both countries, and in part due to the lack of government transparency and regulatory enforcement in mining sectors of Ghana and Guinea. Improving transparency, regulatory enforcement, and feedback mechanisms between local communities, firms, and government can ensure that mining investments through RFI agreements are socially, economically and environmentally sound.

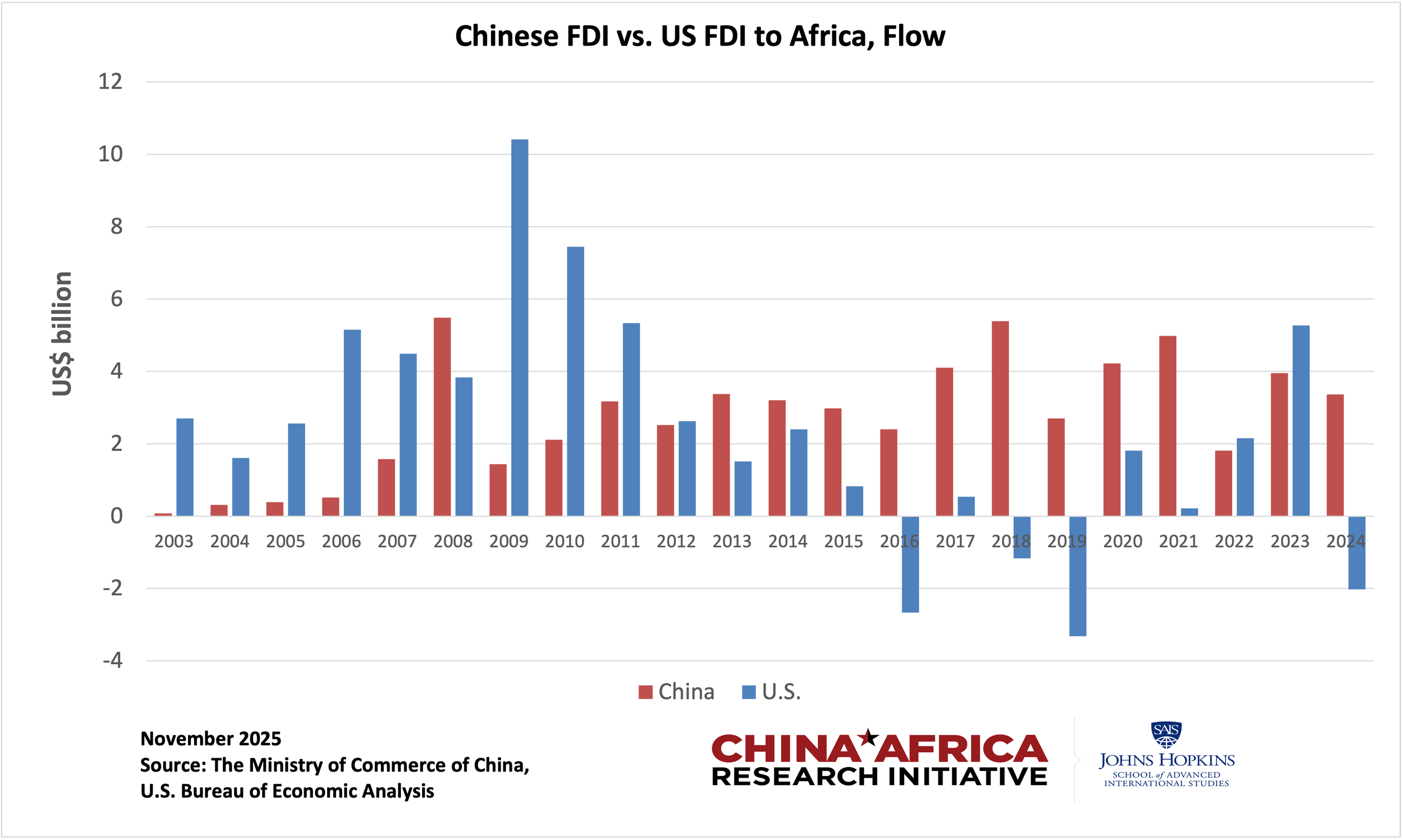

Has the US Overtaken China in African Investment?

November 17, 2025

By Deborah Brautigam

Last week we had a flurry of email requests from reporters who wanted to ask us about the comparative Africa foreign direct investment (FDI) data on China and the US posted on our SAIS-CARI data page. Someone at the BBC had noticed that in 2023, US annual flows of FDI surpassed China's for the first time in a decade. The BBC didn't reached out to us for a comment, but when other reporters piled onto the story, we posted the 2024 data. In 2024, China's annual flows of FDI reached US$3.37 billion, while US FDI flows were negative, at --US$2.02 billion. This means that across the board, in 2024 US firms were selling off equity rather than investing.

However, it's important to remember that for both the US and China, FDI data is notoriously incomplete.

Read more on CARI’s blog.

Interactive Database – Chinese Loans Commitments to Africa

The Chinese Loans to Africa (CLA) Database is an interactive data project started by SAIS-CARI in 2020.

Since 2007, SAIS-CARI researchers have collected, cleaned and analyzed publicly-available data to create a database on Chinese lending to Africa. The data sources include official government documents, contractor websites, fieldwork, interviews, and media sources.

Between 2000 and 2019, SAIS-CARI estimated Chinese financiers signed 1,141 loan commitments worth US$153 billion with African governments and their state owned enterprises. The figures are not equivalent to African government debt, as the database does not track disbursement or repayment.

As of March 29, 2021, the Chinese Loans to Africa Database is managed by the Boston University Global Development Policy Center.